Contact

MOYCOM.DE

Strategic Alliances Central, South East and Eastern Europe

F. Juergen Moy

Communications Advisor, Technology Evangelist - Cloud and Data Science

Greinwaldstrasse 13

D-82327 Tutzing am Starnberger See (Munich)

GERMANY

SOCIAL MEDIA

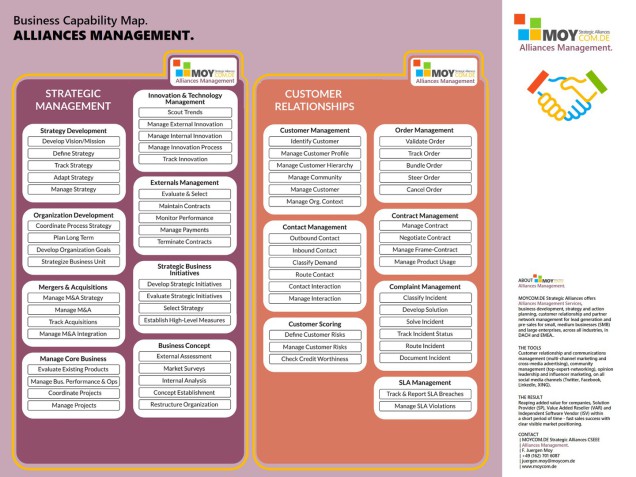

Alliances Management - Strategic Corporate Enterprise Cooperations and Business Relationship Management

Download PDF (509,0 KB):

About Strategic Corporate Enterprise Cooperations and Business Relationship Management

What is Alliance?

Duration: 3:04

What is Relationship Marketing?

Duration: 2:21